- Supermode

- Posts

- What have I been up to?

What have I been up to?

since my last email in April 2024

In April 2024, I realized I was performing.

Twitter made it easy to do that. If you’re building in public, there’s always something to say. A thought. A thread. A take. For a while, it was exciting. Attention feels like progress when you’re early. But it’s a trap. A status game. A zero-sum loop where you start optimizing for external validation instead of internal alignment.

Eventually, it stopped being fun.

I noticed I was writing for other people instead of building the life I actually wanted. I was optimizing for signal instead of truth. That’s a hard thing to admit, especially when the feedback is positive.

So I quit. Not dramatically. I just stopped showing up.I put my head down and went back to what I enjoy most: building.

Around that time, I decided to stop being a personality and start being an operator again. I designed the life first, then worked backward into a business plan that could support it. Not the other way around.

The goal was simple. Equanimity over expectations. Intellectual honesty. Work that compounds. Enough independence that money gets dethroned. As Naval says, I wanted to live at the intersection of what feels like play to me but looks like work to others. Once that became clear, the strategy choices got easier.

Found a partner

The first foundational decision wasn’t about business at all. It was about partnership.

I focused on finding someone I could build with for the long term. Looking back, social media gave me many things, but the most important one was the connection to my partner. He’s been a godsend. We share the same values, long-term thinking, fast iteration, and learning by doing, but our skill sets are distinct. That complementarity removed friction. We don’t debate endlessly. We execute.

That clarity spilled directly into the business.

Built a full-blown property management in-house

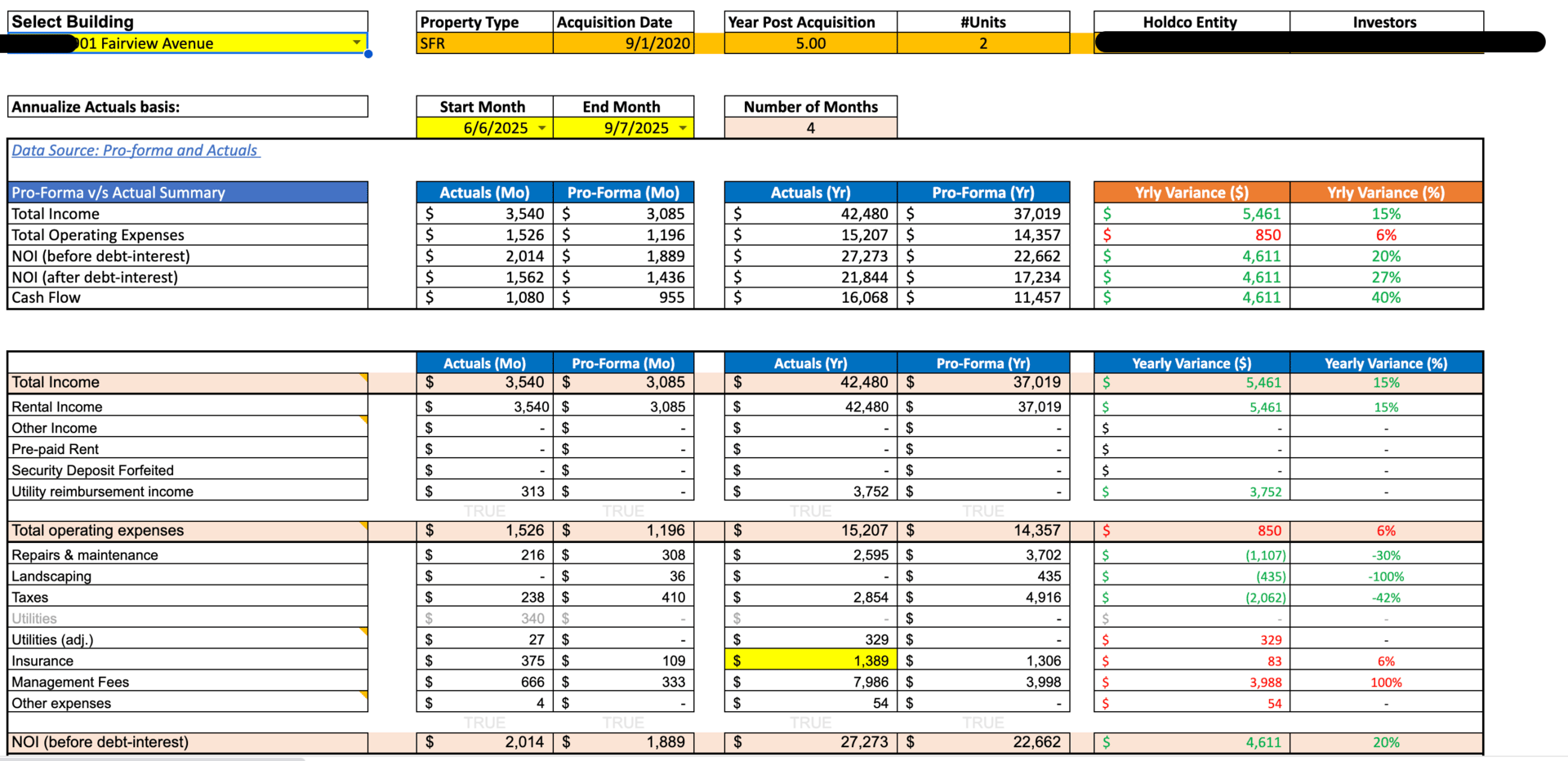

Actual vs Pro-Forma Analysis for a property

The next thing we fixed was property management. Working with third-party managers had been a nightmare. No visibility. No urgency. And most importantly, misaligned incentives. They make money when you lose money. Once you see that clearly, you can’t unsee it.

So we built our own. It only manages in-house properties. No growth ambition. No external clients. Just alignment. If something goes wrong, it’s our fault and we see it immediately. That alone removed a constant layer of background anxiety.

After that, I leaned hard into talent arbitrage.

Global Hiring

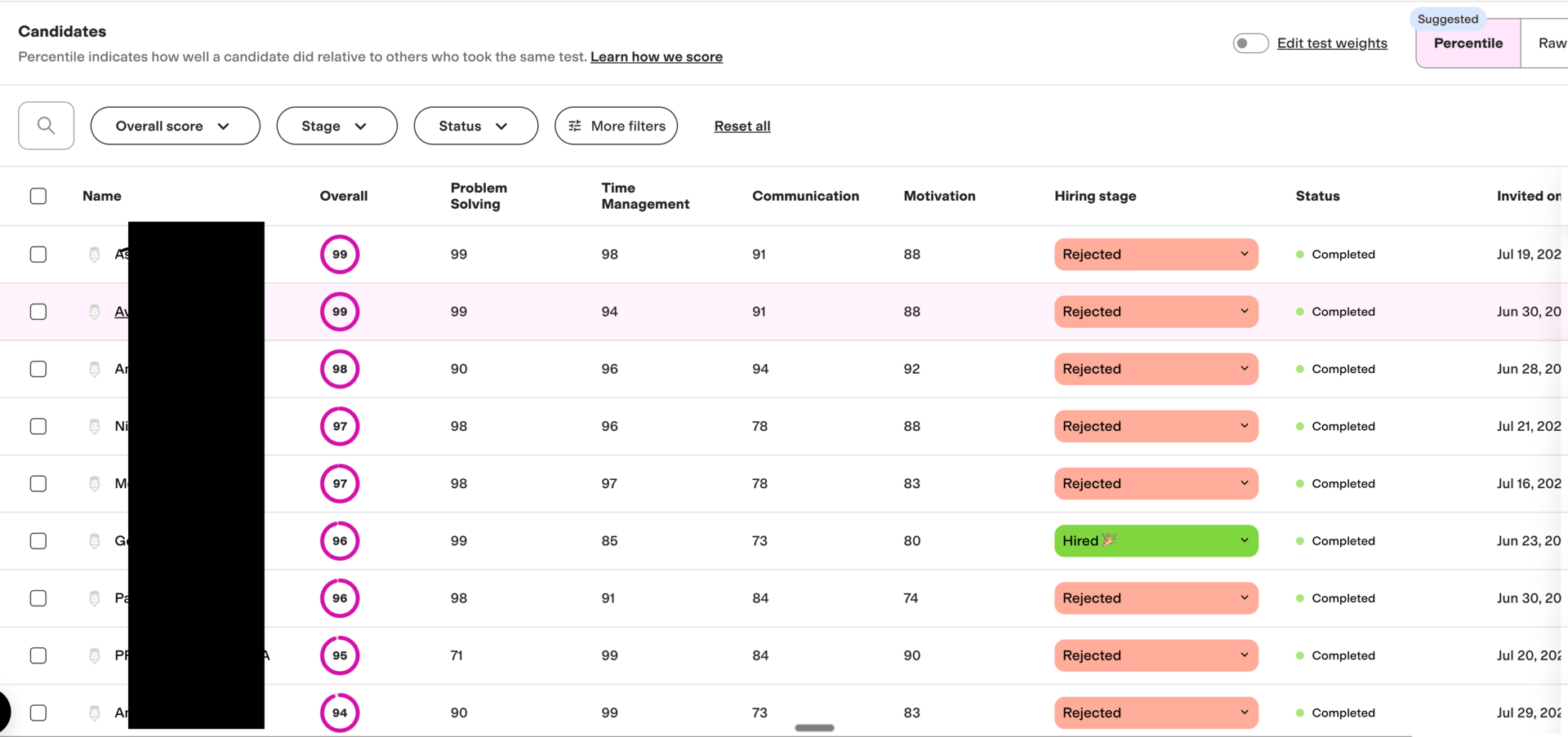

We were becoming the bottleneck. So we built a hiring framework to find the most committed and capable people globally and gave them real autonomy and real ownership. That freed up our time to focus on the only things we should be doing. Judgment. Capital allocation. Direction.

Skill based hiring

The next major decision was capital.

Raised a fund

We raised a small fund, about a million dollars, focused on flips. It’s small because we can recycle the money at high velocity through flips. I was conflicted about this for a while. Raising money can quietly turn into another job where you’re selling your time through updates and reassurance. But I realized something important. If capital comes from the right people, sophisticated, aligned, already in your inner circle, it becomes passive leverage. They want returns, not performance. That lets us stay focused on execution.

This is the original fund memo, so you can get a tactical understanding. Please note this memo is for context only. Not an offer, solicitation, or investment advice.

As we scaled, another constraint became obvious. Acquisition channels were too expensive and too competitive. We were leaving money on the table by relying on the same paths everyone else uses. MLS. Wholesalers. Agents.

So we went directly to the sellers.

Direct to seller marketing

That decision cascaded into building a real machine. A marketing engine. A custom CRM because nothing off the shelf fits how we actually think. An AI voice agent that qualifies leads and sounds human. Automations to pull better data faster. It was messy and unsexy. But it worked because it was built on technical leverage, not just hustle.

Custom CRM Example

Then something unexpected happened.

A Wholesaling arm

Some properties didn’t fit our flip buy box. Instead of forcing them, we sold them to other buyers. That turned into a revenue stream. Now we have a full funnel of inbound properties. Some we keep. Some we sell. All of it feeds back into the engine.

One real example is this live 6 single-family off-market deal in Birmingham for just $550k.

P.S. - If you are interested, just reply to this email.

None of this was planned up front.

It emerged by paying attention to friction. Each step was about removing a source of stress or misalignment rather than chasing growth for its own sake.

The long term goal hasn’t changed. Maximum passivity. Returns that are good enough that they’re boring. Capital that stays aligned. I’ve noticed that the smartest people eventually stop shouting and start building in private. Like Jim Simons, they realize that real compounding happens in quiet corners where you’re not distracted by an audience. If outside investors ever become a distraction, we’ll keep things in-house and compound quietly with a small, elite team.

What surprised me most was how much I enjoyed building without talking about it.

But I did miss one thing.

Helping people. Not performing. Not signaling. Actually saving someone years of mistakes or unnecessary risk. Most of the lessons that matter sound like clichés until you earn them the hard way. I want to share the unteachable lessons picked up in the trenches.

So Supermode is back. Quietly.

This isn’t a promise to publish on a schedule. Forcing cadence usually leads back to performing. Instead, this is an intent to share when there’s something real to say. Over the next few weeks, I’ll write when the signal is high and the lesson is sharp.

If something here helps you move faster with more leverage and fewer scars, it’s worth sending.

That’s the only goal!

Vidit

P.S - Please do reply. I'm not a robot, I talk back. If these emails aren't for you anymore, you can unsubscribe using the link below.